Money management is a skill that all teens, adolescents and adults should know.

“Money management can make or break your ability to advance in life stages. Such stages as buying a car, moving out of your parent’s house, retiring, etc. If you can’t save, plan, and manage accordingly, you won’t be able to advance to the next stage,” said Shawn Jones, a financial advisor student from Centennial College.

Good money management according to Robert Schaud, senior systems analyst with the Royal Bank of Canada, is “essentially being effective in managing expenses and savings within a given income. Planning for investment, minimizing borrowing need and growing financial security.”

According to a government of Canada website, you need to evaluate your needs versus your wants:

“A need is something that is necessary, required or essential. For example, a roof over your head, clothing, food, or medication.”

“A want is something that you’d like, but don’t necessarily need. For example, meals at a restaurant, a trip, a gym membership, or designer shoes.”

“Needs and wants aren’t the same for everyone. One person’s want may be another person’s need. For example, if you live near a bus route, a car may be a want rather than a need.”

The site also says you should consider creating a budget if you have any of the following issues:

- have trouble paying your bills

- don’t know where your money is going

- have problems paying off your debts

- don’t regularly save

- want to find ways to make the most of the money you have

- want to plan financially for major purchases such as a home, car or travel

- want to prepare financially for important events such as retirement, having children or going to school

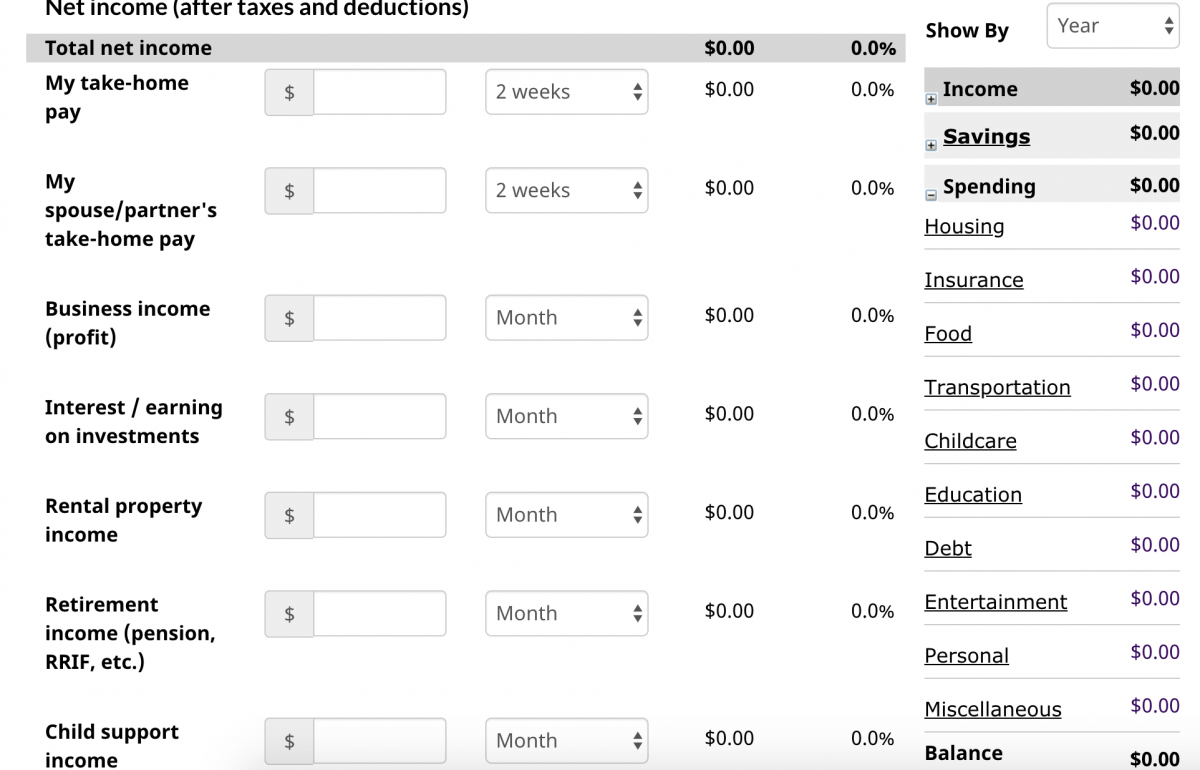

You can take your first steps towards budgeting by using the site’s budget calculator. Here you can budget your spending and finances, so you can stay organized and reach your goals.