By Tommy Desormeaux and Raymond Cabbab

Stay home advisories and work stoppages have brought many businesses to a grinding halt in Canada. Many information-based office jobs can be done from home via phone calls and the internet. However, work in the service industry, which is common among young people, has been dramatically, leaving many people in financial jeopardy.

Kimberly Doran, a 22-year-old full-time bartender in Mississauga’s Port Credit area, was recently given a “temporary layoff” from the pub where she works.

“I will have my job back when this is over,” she says. “Permitting the restaurant is still open.”

“Depending on how long this goes on, things could get financially tight.”

The temporary layoff will allow her to apply for Employment Insurance Benefits (EI) or the new Canada Emergency Response Benefit (CERB).

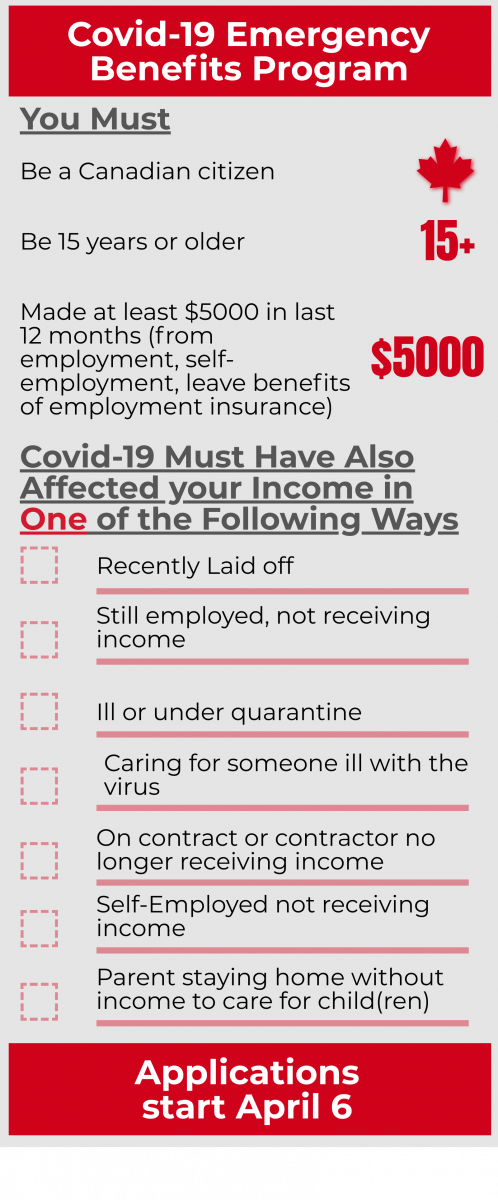

On Wednesday, March 25, the government introduced the CERB. The aim of the benefit is to financially support Canadians during the COVID-19 outbreak. The CERB is a taxable benefit that will provide Canadians with $2,000 a month for up to four months.

The government will be accepting applications for the CERB on April 6. Canadians can apply through a web portal, automated telephone line, or toll-free number. The number and website are still to be announced. Canadians are expected to receive payments within ten days of applying. The CERB applies retroactively to March 15 and is available until October 3, 2020.

Canadians already receiving EI or sickness benefits should not apply for the CERB. If they have applied for EI but their application has not been processed yet, they do not need to apply for the CERB. If their EI or sickness benefits end before October 3, 2020, they may apply for the CERB as long as they qualify. Canadians will still have access to regular EI and sickness benefits after the 16-week period covered by the CERB.

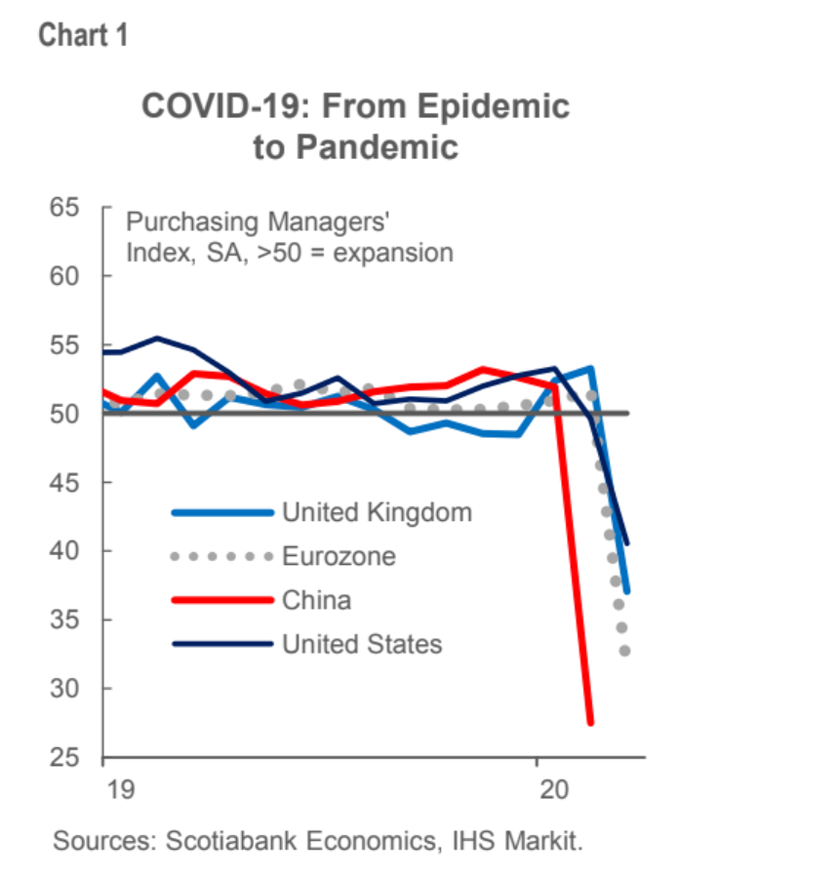

Helping Canadian consumers not only keeps individuals safer but puts much needed money back into businesses. Stimulating consumption is also important to helping to keep the economy afloat during the Covid-19 crisis.

Sheridan economics professor, Jason Dean, says that Canadians having extra money to spend on things other than just essentials will give a much needed “boost to the Canadian economy.”

Supporting the economy is a grave concern in this moment when many businesses are laying off employees and closing their doors for the immediate future.

Putting money in Canadian pockets with benefit programs can be a big help, especially when gas prices are so low. According to Dean, increased consumption “will actually help offset some of the decline in economic activity related to the Coronavirus.”

And back in Missississauga, for Doran, CERB can’t come soon enough.

“I wouldn’t normally apply for something like EI or the Covid-19 relief fund. I find it necessary because the number of jobs available has decreased drastically so my chances of finding another job are slim,” Doran says.

“I don’t have as many bills as the average adult, but I still have some that add up,” she says. “The government keeps extending deadlines for when things can open back up so who knows how long it will actually last.”

“Even if I could find a job, I don’t really feel like putting myself and my family at risk by going to work every day and interacting with people who could be spreading the virus.”