The 2020 tax return in Canada will be different this year for those who received benefits because of COVID-19.

In 2020 the Government of Canada implemented measures to support Canadians who went through different economic difficulties, such as losing their jobs or students who could not find summer employment to meet their needs.

The different financial supports that the Government of Canada implemented in 2020 were Canada Emergency Response Benefit (CERB), Canada Emergency Student Benefit (CESB), Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB), or Canada Recovery Caregiving Benefit (CRCB).

People who received these benefits must pay taxes on the amount they received since no taxes were withheld from them. The president of the Knowledge Bureau Evelin Jacks said to CTV News, “if you received CERB that was good news, but the bad news is they didn’t withhold any tax from it. So, you’re going to have to report that in your income this year.”

The Government of Canada website states that if someone received the Canada response benefit payments these are considered taxable income and they must enter the total amount they received on their tax return.

“We recognize that for some individuals, repaying these benefits could present significant financial hardship. For this reason, payment arrangement parameters have been expanded to give Canadians more time and flexibility to repay based on their individual financial situations,” Government of Canada website.

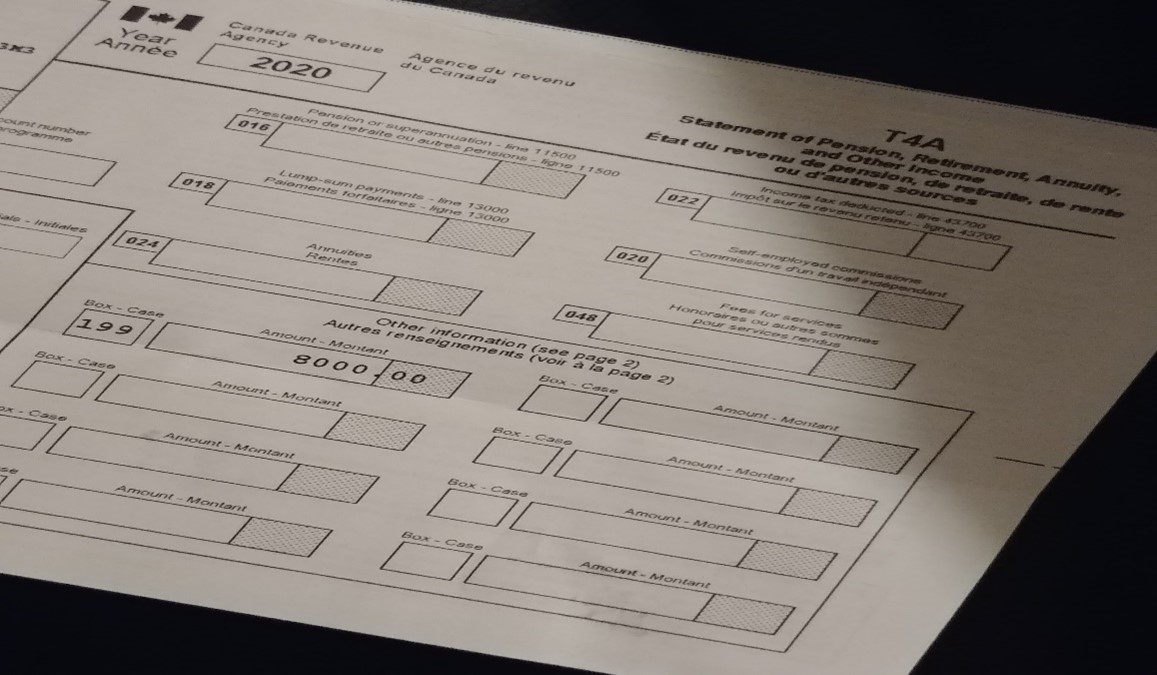

Anyone who received the benefit will receive T4A tax receipt in February from the Canada Revenue Agency with the amount of the benefit to include in their taxes.

Full-time or part-time students can claim their federal tuition tax credit. If the student does not need the full amount this year, can use it in the future or transfer it to reduce the taxes to some family member. Also, students must claim the interest they paid on their student loans to reduce the amount of the taxes.

International students have to determine their residency status (Resident, Non-resident, Deemed resident, and Deemed non-resident) to declare their taxes, and if they received the CERB they will have to declare it.

People who have worked from home can claim up to $400 as a tax deduction.

Advice from the Government of Canada is that you pay your taxes on time so that you do not have to pay any penalty for filing your return late. The deadline to file your 2020 taxes is on or before April 30, 2021.

If you have questions about how to make your taxes or what you must pay, you can communicate Canada Revenue Agency 613-948-8366 cra-arc.media@cra-arc.gc.ca